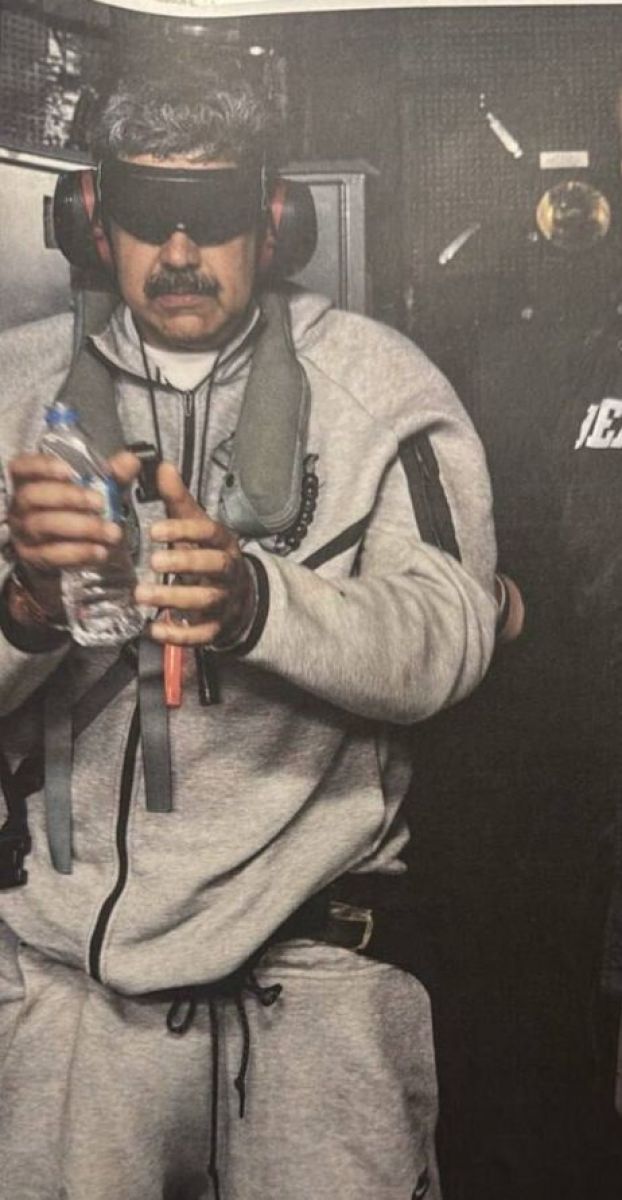

In Mask and Headphones: Trump Posts Photo of Detained Venezuelan President Однако, такое событие маловероятно, так как на данный момент действующий президент Венесуэлы — Николас Мадуро — не был задержан. Возможно, заголовок

03 January 20:03

© ООО Региональные новости