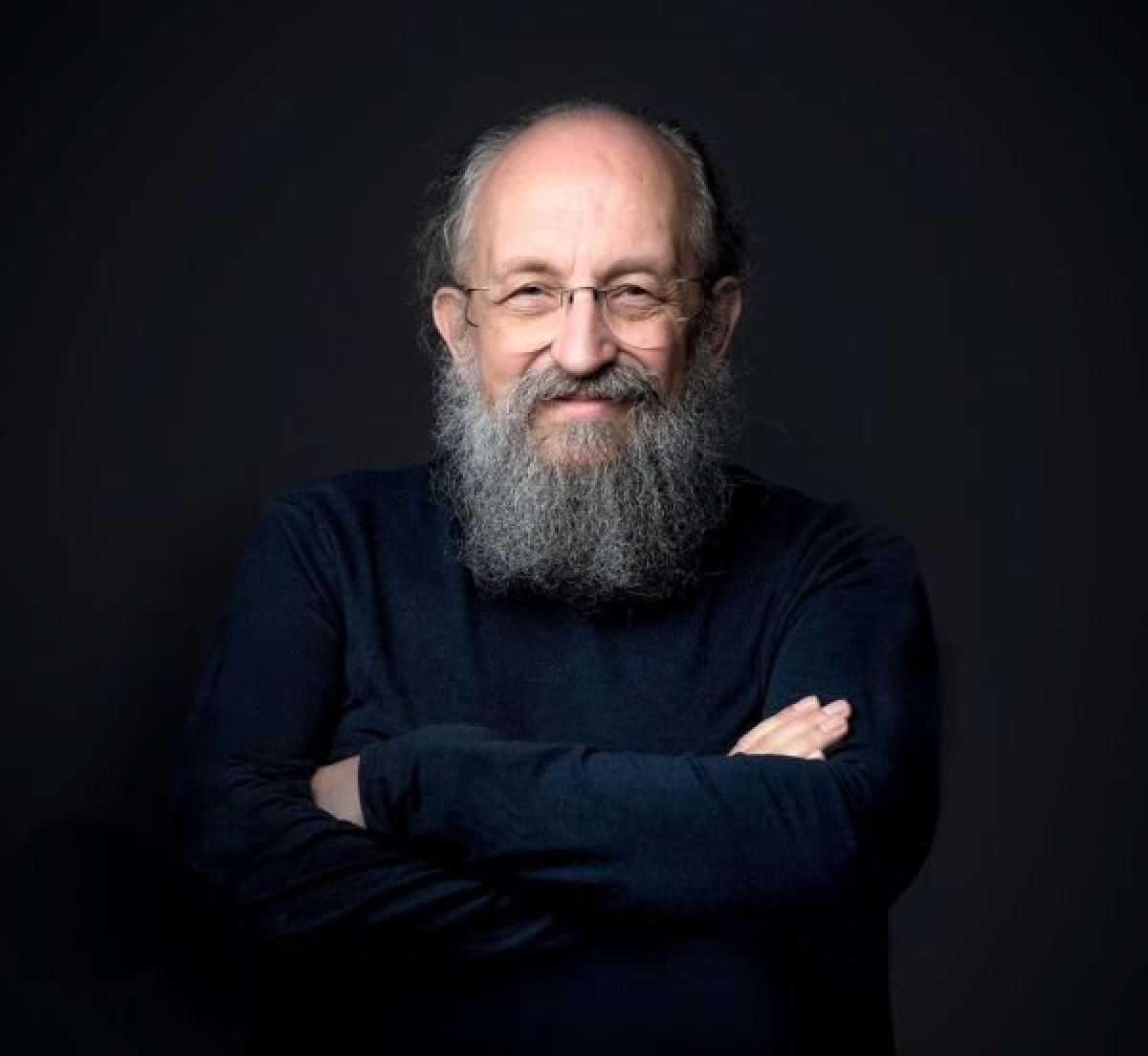

Wasserman commented on the powerful information wave around the Central Bank

The high key rate of the Central Bank is not what the economy needs today. «The key » at the level of about 10% does not cause much harm, but above it already promises risks, according to State Duma deputy Anatoly Wasserman. The chief intellectual of the Russian Parliament gave a long interview to the Federal Business Magazine and answered directly the questions that have been floating in the information space for months.

— Does The Central Bank have no other ways to stabilize the economy than by juggling the rate? Why is this happening?

— Because the Central Bank, according to the law on the Central Bank, has the only task — stabilization of the ruble, and the Central Bank itself interprets this task not as maintaining a stable exchange rate, but rather stable prices, but as limiting the level of inflation. According to the law, our Central Bank is not responsible for the state of the economy as a whole. Another thing is that the state of the economy undoubtedly affects the ruble exchange rate, but the liberals have been weaning us off tracking a chain in which more than one cause-and-effect relationship for many years, this is among the main tenets of the totalitarian sect. It practically does not recognize any complex technological chains, any complex logical chains, and so on. So, as far as I can tell, the heads of the Central Bank are now simply refusing to track those chains of cause-and-effect relationships that lead their policies to the opposite of what they want.

The full version of the video interview with Anatoly Wasserman will be published on our website soon.